1099 Tax Form 2023 Printable

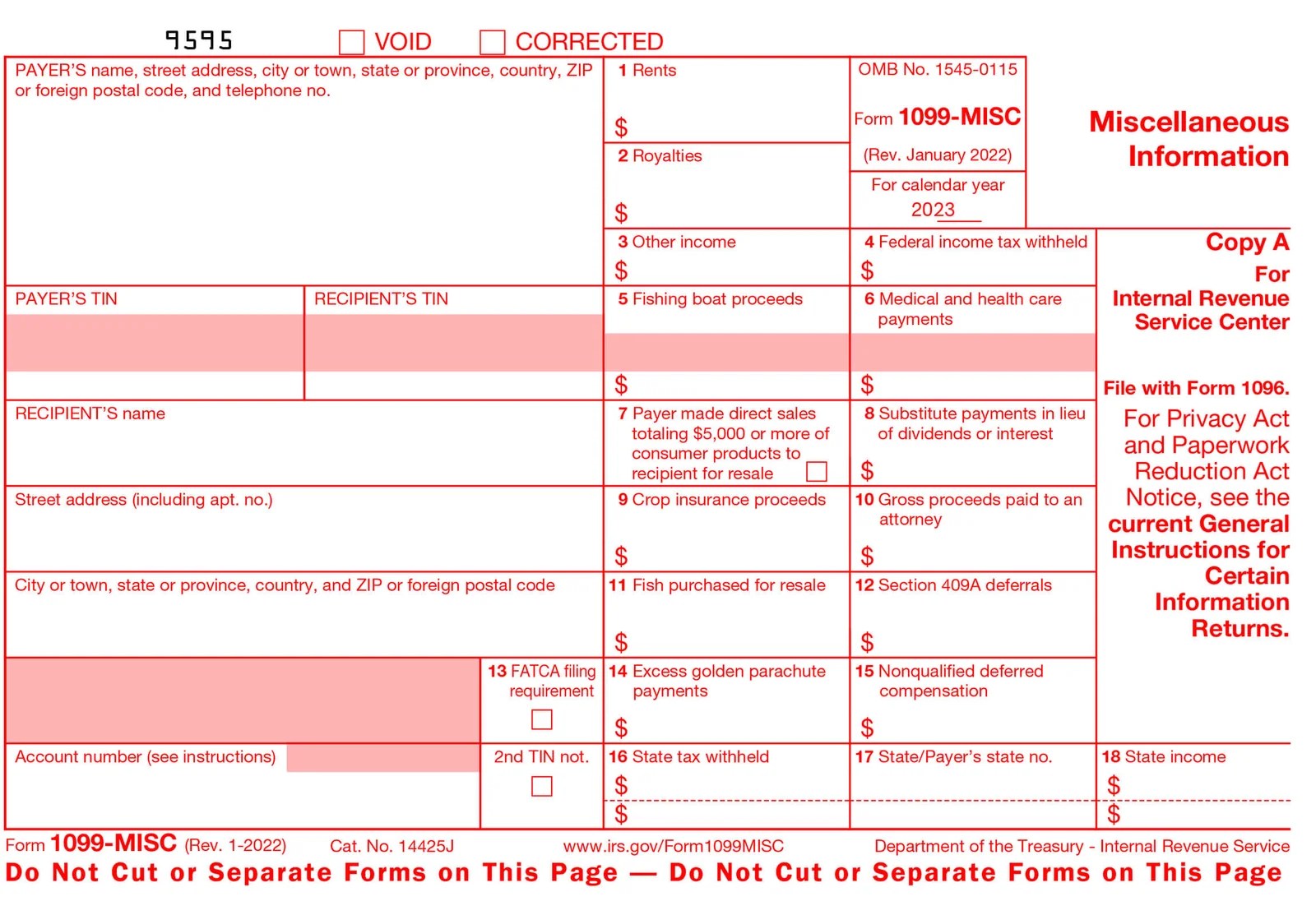

1099 Tax Form 2023 Printable - If you paid a contractor or freelancer over $600 in a year, you need to send them a 1099. Use these instructions for tax year 2025 and subsequent years until a superseding revision is issued. Can you print 1099 forms from a regular printer? Everything you need to know. Do not print and file copy a from. This is the official pdf form for reporting nonemployee compensation, royalties, rents, and other income. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance.

IDOC Help Where is the 1099 Tax form, or what does it look like? r/ApplyingToCollege

Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Everything you need to know. Can you print 1099 forms from a regular printer? This is the official pdf form for reporting nonemployee compensation, royalties, rents, and other income. Use these instructions.

2023 Tax Documents from TD Ameritrade and Charles Schwab EKS Associates

Do not print and file copy a from. Everything you need to know. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Can you print 1099 forms from a regular printer? Use these instructions for tax year 2025 and subsequent years.

2023 Printable 1099 Form Printable Forms Free Online

Can you print 1099 forms from a regular printer? Do not print and file copy a from. Use these instructions for tax year 2025 and subsequent years until a superseding revision is issued. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as.

1099 MISC Form and other tax forms Online only at StubCreator

Everything you need to know. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Can you print 1099 forms from a regular printer? If you paid a contractor or freelancer over $600 in a year, you need to send them a.

2023 1099 Form Generator Quick, Accurate, and Compliant

This is the official pdf form for reporting nonemployee compensation, royalties, rents, and other income. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Everything you need to know. If you paid a contractor or freelancer over $600 in a year,.

1099 INT Form PDF Template 2024 2023 With Print and Clear Buttons Etsy

Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Can you print 1099 forms from a regular printer? Everything you need to know. This is the official pdf form for reporting nonemployee compensation, royalties, rents, and other income. Do not print.

Employee 1099 Form 2023 Printable Forms Free Online

If you paid a contractor or freelancer over $600 in a year, you need to send them a 1099. Everything you need to know. Use these instructions for tax year 2025 and subsequent years until a superseding revision is issued. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside.

Printable Blank 1099 Form

Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Do not print and file copy a from. This is the official pdf form for reporting nonemployee compensation, royalties, rents, and other income. If you paid a contractor or freelancer over $600.

2023 IRS Form 1099NEC/MISC Simple Instructions + PDF Download OnPay

Use these instructions for tax year 2025 and subsequent years until a superseding revision is issued. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Can you print 1099 forms from a regular printer? Do not print and file copy a.

2025 Tax Forms Jasmin C Hedegaard

Can you print 1099 forms from a regular printer? Everything you need to know. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Do not print and file copy a from. If you paid a contractor or freelancer over $600 in.

Can you print 1099 forms from a regular printer? Do not print and file copy a from. If you paid a contractor or freelancer over $600 in a year, you need to send them a 1099. Use these instructions for tax year 2025 and subsequent years until a superseding revision is issued. This is the official pdf form for reporting nonemployee compensation, royalties, rents, and other income. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Everything you need to know.

This Is The Official Pdf Form For Reporting Nonemployee Compensation, Royalties, Rents, And Other Income.

Everything you need to know. Can you print 1099 forms from a regular printer? Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Use these instructions for tax year 2025 and subsequent years until a superseding revision is issued.

If You Paid A Contractor Or Freelancer Over $600 In A Year, You Need To Send Them A 1099.

Do not print and file copy a from.

:max_bytes(150000):strip_icc()/1099-DIV2022-d0ba6b5ac8f74b89bf8cb5a6babe705c.jpeg)